The present administration in the country is an enigma of sorts and will remain so for a long time to come. The government, through the Federal Ministry of Finance, has proposed a legislative framework that would strip the Nigeria Customs Service (NCS) of its primary responsibility of revenue collection.

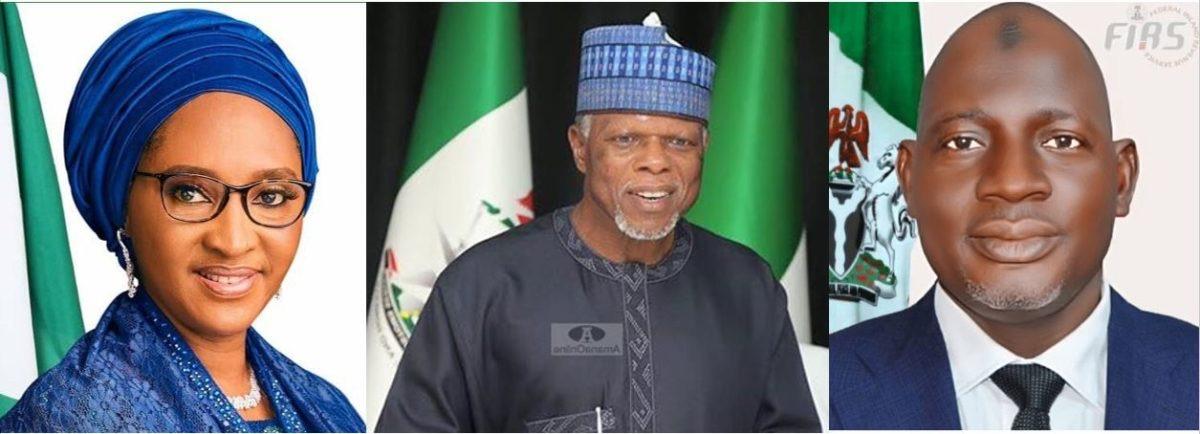

According to the government, the sole responsibility of collecting revenue should be domiciled with the Federal Inland Revenue Service (FIRS), while NCS facilitates trade. This government thinking was voiced by the Minister of Finance, Budget and National Planning, Zainab Ahmed, at a one-day public hearing on a bill for an Act to repeal the Customs and Excise Management Act (2004) and the Nigeria Customs Service (establishment) Bill. The legislative session was organized by the House Committee on Customs.

The bill also seeks to “rejig the board of customs and excise management with competent and result-oriented technocrats,” according to the sponsor of the bill and Chairman of the Committee, Leke Abejide.

The move by the finance ministry to strip the Nigeria Customs of its revenue collection responsibility, and transfer it to the Federal Inland Revenue Service (FIRS), is rather preposterous. This is more so as the argument in favour of this move is standing the truth on its head.

Amplifying his boss’s statement, at the public hearing, the Permanent Secretary in the Federal Ministry of Finance, Aliyu Ahmed, said there was need to unify revenue collection so that Customs can concentrate on its responsibility of trade facilitation.

He said, “The single most important function of the Customs Service anywhere in the world is trade facilitation. But in the introduction of the Chairman, I hear him talk about revenue, collection of revenue. This is the secondary service of the Customs all over the world. Revenue collection by Customs is a distraction. The reason is that the main function of the Nigeria Customs Service is trade facilitation. But the trade facilitation has been pushed to the background because of the focus on revenue collection. In other climes, the best practice is moving towards unifying revenue collection.

“If we want to go that far, and achieve that best practice, our submission would be to move revenue to the Federal Inland Revenue Service so that Customs Service can really focus on trade facilitation function.”

This argument is severely flawed and very far from the truth. Saying that collection of revenue by the NCS is a distraction and that it is not their core function is a portrayal of ignorance of the core function of any customs jurisdiction. It is unfortunate how Nigerian government officials and politicians argue passionately over issues they are not quite competent for selfish or sundry reasons.

As a matter of fact, the traditional function of customs anywhere is the assessment and collection of customs duties. This customs duty is a tariff or tax on the importation or exportation of goods. According to Wikipedia, Customs is an authority or agency in a country responsible for collecting tariffs and for controlling the flow of goods, including animals, transports, personal effects, and hazardous items, into and out of a country.

Customs is part of one of the three basic functions of a government, namely: administration; maintenance of law, order, and justice; and collection of revenue.Traditionally, customs is the fiscal subject that charges customs duties (i.e. tariffs) and other taxes on import and export.

This is the basic or primary responsibility of Customs. And it does this because it is professionally and technically trained and equipped for the responsibility. Trade facilitation everybody is talking about now is a newer responsibility added to customs.

According to Wikipedia, in recent decades, the views on the functions of customs have considerably expanded and now cover three basic issues: taxation, security, and trade facilitation. This implies that trade facilitation is one of the secondary responsibilities of customs and not its primary responsibility as argued by the permanent secretary of the Federal Ministry of Finance.

Trade facilitation is a more recent objective of customs, and is the streamlining of processes of import and export of goods to reduce time and trade transaction costs. The contemporary understanding of the “trade facilitation” concept is based on Recommendation No. 4 of UN/CEFACT “National Trade Facilitation Bodies”. Facilitation covers formalities, procedures, documents and operations related to international trade transactions. Its goals are simplification, harmonization and standardization so that transactions become easier, faster and more economical than before.

While the Nigeria Customs Service cannot neglect this important responsibility, it cannot be stripped of its core responsibility of customs duty collection. Assessment and collection of customs duty remain its primary responsibility which cannot be transferred to FIRS or any other institution.

And come to think of it, does the FIRS have the requisite know-how to collect customs duty? The Nigeria Customs Service, like its counterparts all over the world, is a professional body. Its work is highly technical. Does FIRS have technical competence? Does it know anything about classification, valuation, HS Codes, and Rules of Origin?

It is clear that the Federal Ministry of Finance and all those who are proposing that the FIRS take over the revenue collection function of customs are not aware of the technical nature of customs job, or they have chosen to ignore it for pecuniary reasons. If they are aware of this, and are asking for customs duty collection to be transferred to FIRS, it means they have ulterior and pecuniary motives.

Being aware of the technical deficiency and incompetence of FIRS and pushing for its take-over of customs job only means that the government is preparing the ground for consultants or its cronies to take over the revenue collection responsibility of customs, as there is no way the FIRS can do the work of Customs without employing consultants. Or perhaps, the government is preparing the way for the return of pre-shipment inspection, which has never solved any problem, but only worsened matters.

And is the FIRS that will take over the responsibility from Customs the one that is riddled with corruption, and cannot collect all the taxes and revenues accruable to the country? It is on record that FIRS officials strike fraudulent deals with big companies, including multi-national companies to evade or to pay inappropriate tax. Some are granted questionable tax rebates and tax holidays, Top officials of the agency are also known to have misappropriated the funds they collect for government.

Similarly, the Federal Ministry of Finance has been a major obstacle to NCS efforts to collect maximum revenue. All the fraud in import duty waivers, concessions and exemptions are perpetrated through the Ministry. In the last three years, over N1.4trillion has been lost to waivers and concessions. Elsewhere, import duty waivers, concessions and exemptions are used by governments to protect and grow local industries, boost the economy and create jobs, but in Nigeria, they have been so grossly abused, and have become a conduit pipe to siphon public funds.

The Federal Ministry of Finance has been presiding over these frauds and losses, by granting waivers and concessions to cronies, friends, political associates etc, and by not monitoring and ensuring that the concessions and waivers are used appropriately. Can the ministry point to anywhere the incentives have been appropriately used with corresponding concrete benefits?

Evidently, the contention of the Ministry that collection of revenue by customs is a distraction does not hold water. The same goes for the statement that stripping them of the function is the best practice. The Finance ministry’s permanent Secretary ought to be told that customs all over the world assess and collect customs duty in addition to trade facilitation. And if he would like to hear the truth, the best practice is that customs are left to do their work.

What customs need is adequate funding, empowerment and appropriate laws to meet the needs of modern service. This are what’s obtainable in other climes the ministry was bandying about. They always hide the facts that in those climes, government functionaries, including the ones in their finance ministries, are not fantastically corrupt, and do not sabotage or circumvent their country’s fiscal policies, neither do they use government’s industrial incentives to favour their families, friends, cronies, business and political associates.

Therefore, seeking to transfer the function of customs to the FIRS will be an aberration that will not benefit the economy, but only a few privileged individuals. A government that professes to fight corruption should not be seen creating many avenues for corruption. Unequivocally, the proposal by the Ministry of Finance should be dropped as it lacks merit and is founded on the wrong, highly misleading and selfish driven premise.

The proponents of the absurdity is akin to the gathering of desperate vultures. Yes, the vultures that are impatiently angling to viciously feast on the carcass of an economically struggling nation.

Article written by Okey IBEKE, the Principal Consultant, International Trade Advisory Services Limited.

First appeared on Business and Maritime West Africa.